Tax Rate Breakdown

School funding in Texas is made up of different parts, and terms like “Golden Pennies” and “Copper Pennies” can be confusing at first glance. This page provides a high-level look at how the tax rate would be structured if Proposition A is approved by voters.

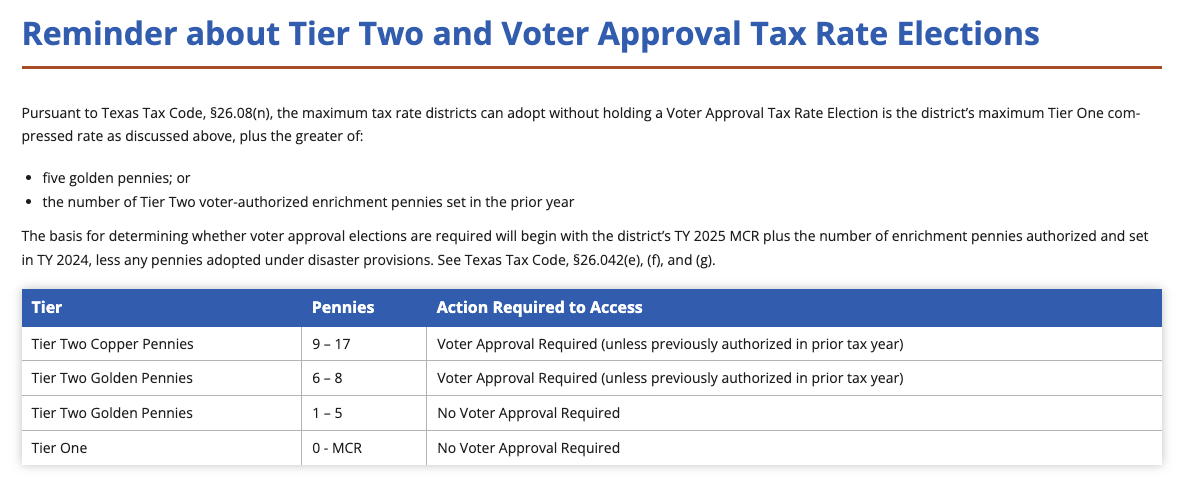

The table below outlines how each portion of the tax rate is determined, what those dollars can and cannot be used for, and why the distinction between Golden and Copper Pennies matters. For those who want a deeper dive, links to the Texas Education Agency’s official resources are also included at the bottom of the page.

Liberty Hill ISD Tax Rate Breakdown

Important: The information below shows the Maintenance & Operations tax rate breakdown if Proposition A is approved by voters.

COMBINED Tax Rate (M&O + I&S)

Total 2025-26 M&O Tax Rate

2025-26 I&S Tax Rate

How the “Pennies” Work (within the M&O Rate)

The M&O rate is built from Tier 1 and Tier 2 “pennies.” Golden Pennies are not subject to recapture.

| Tax Rate Part | Rate | Who Decides? | Notes |

|---|---|---|---|

| Tier 1 Compressed Tax Rate | $0.59 | Set by the State | Based on current law, the State will continue to compress the M&O tax rate every year. |

| Tier 2 Golden Pennies | $0.05 | Board Approval – No recapture |

Generates $10.7M in 2025-26, after recapture payment. $0.15 will be available to add to the compressed M&O tax rate in the future for additional funding each year. |

| Tier 2 Golden Pennies | $0.03 | Voter Approval Required – No Recapture (only available if Proposition A is approved) |

|

| Tier 2 Copper Pennies | $0.07 | Voter Approval Required – Recapture payment to the state (only available if Proposition A is approved) |

|

| These amounts together make up the $0.74 M&O rate shown above. | |||

• The M&O rate is most often applied to everyday operations such as teacher and staff salaries, classroom instruction, utilities, safety, and transportation.

• The I&S rate is most often applied to long-term debt, such as constructing new schools, renovations, and repaying voter-approved bonds.

• Golden Pennies stay in LHISD and are not subject to recapture; Copper Pennies are subject to recapture by the State.

This breakdown is intended to show how the tax rate is structured and what the different portions are generally used for, helping reduce confusion about how district funds are managed.

How Do the “Pennies” Actually Work?

If you’re interested in learning more about how school tax rates and “pennies” work across Texas, the Texas Education Agency has a detailed explanation. The resource covers how the state compresses the Tier 1 tax rate each year, how Golden and Copper Pennies fit into the system, and why these parts of the tax rate matter for local school funding.

You can learn more on the TEA’s Tax Year 2025 Maximum Compressed Tax Rates webpage.